Table of Contents

- Introduction

- Why Use Budgeting Apps?

- How Budgeting Apps Work (Family Flow)

- Challenges Without Budgeting Apps (Reality Check)

- Best Budgeting Apps for Indian Families (Top Picks)

- How to Choose the Right App (Family Checklist)

- Quick 20-Minute Family Setup

- Privacy, Security & UPI AutoPay Awareness

- Mini Case Study (Before → After)

- Smart Budgeting Tips for Indian Families

- FAQs

- Conclusion

Introduction

Best Budgeting Apps for Indian Families make it easier to track monthly expenses, plan savings, and keep everyone aligned on household goals. If you’ve tried manual spreadsheets or handwritten ledgers, you already know how hard it is to stay consistent. Budgeting apps reduce the friction: they read expense signals, sort transactions, visualize spending, and gently nudge the family toward better habits.

In this updated guide, we focus on family-friendly, India-ready choices. You’ll learn how Best Budgeting Apps for Indian Families handle SMS banking alerts, how to set up a shared workflow, what to look for in privacy, and which apps shine for different styles (automatic trackers vs. envelope budgeting). By the end, you’ll pick one app, set it up in 20 minutes, and begin a low-stress 30-day family budget challenge. This guide to the Best Budgeting Apps for Indian Families is written to be practical, bias-free, and immediately useful.

தமிழ் குறிப்பு: குடும்ப பட்ஜெட் முறையாக நடந்தால் மன அமைதி அதிகரிக்கும். ஆப் வழியாக தினசரி செலவுகள் தெளிவாகப் பதிவாகும்போது முடிவுகள் எளிதாகும்.

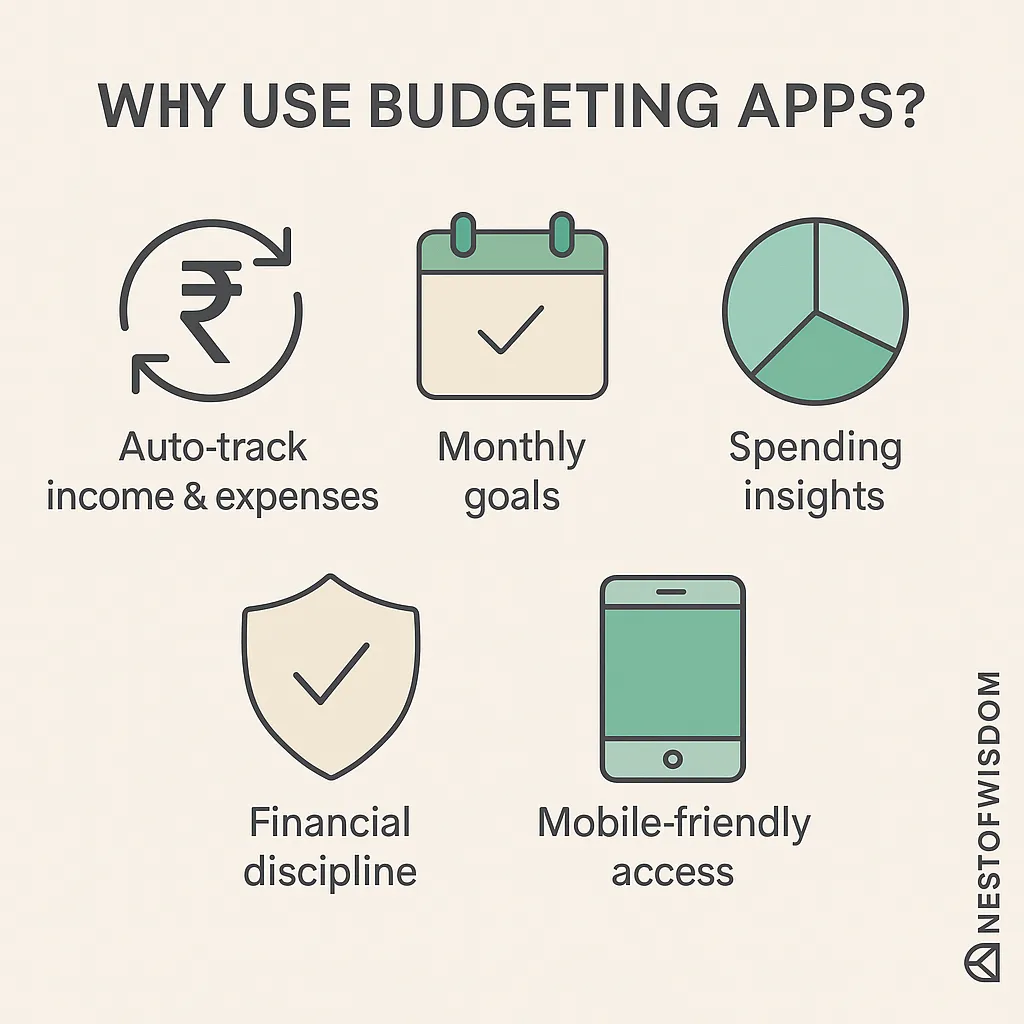

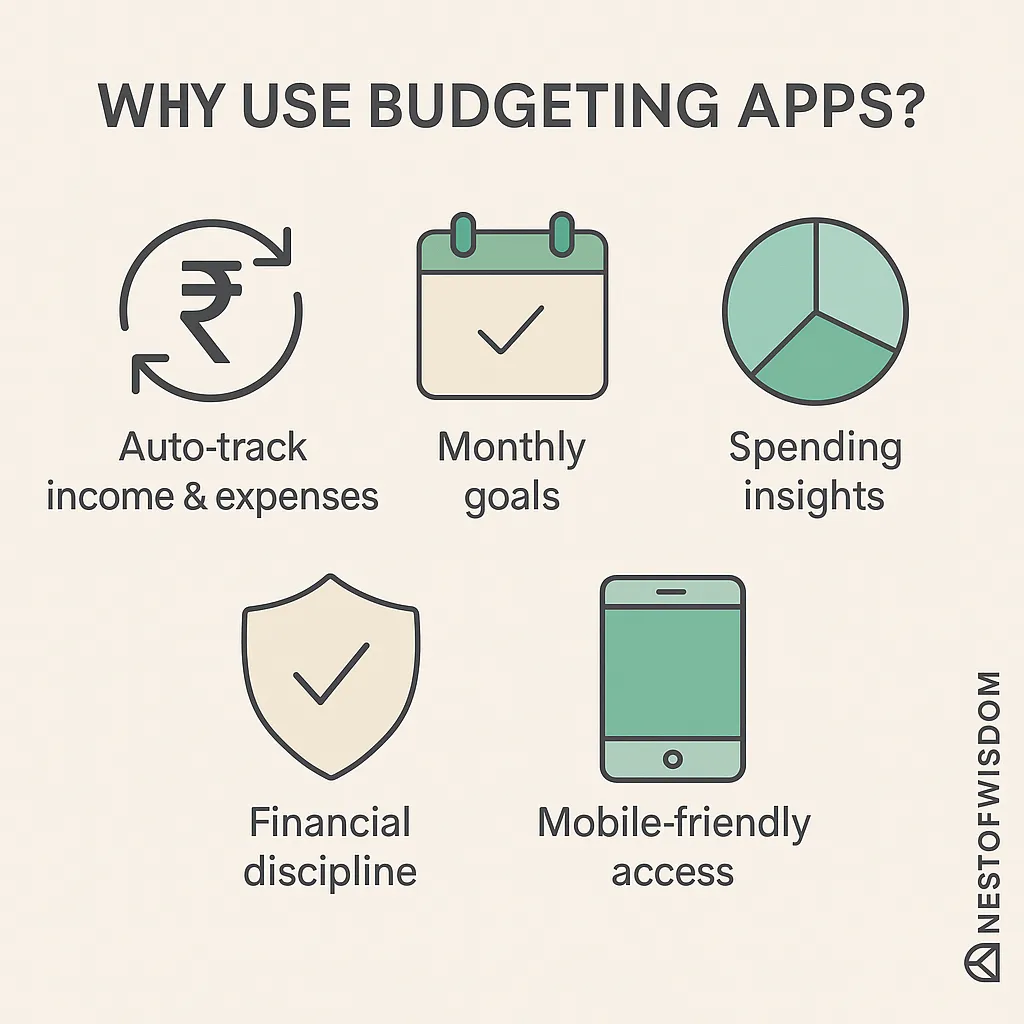

Why Use Budgeting Apps?

Families need clarity. Best Budgeting Apps for Indian Families offer that clarity with five practical benefits: automatic tracking, clear goals, spending insights, daily discipline, and mobile-first convenience. Instead of debating where the money went, you’ll see it.

தமிழ் குறிப்பு: தானியங்கு வகைப்படுத்தல், நினைவூட்டல்கள், தெளிவான வரைபடங்கள்—இவை அனைத்தும் குடும்ப முடிவெடுப்பை எளிதாக்கும்.

How Budgeting Apps Work (Family Flow)

At a glance, here’s the typical flow for Best Budgeting Apps for Indian Families: the app reads an expense signal (often from an SMS alert), suggests a category, updates your charts, and gives the family a shared view to discuss and decide. This “signal → insight → decision” loop is exactly how the Best Budgeting Apps for Indian Families turn scattered swipes into steady habits.

Challenges Without Budgeting Apps (Reality Check)

Why do families slip despite the best intentions? Without the structure of the Best Budgeting Apps for Indian Families, several patterns keep repeating. These gaps are exactly what the Best Budgeting Apps for Indian Families are built to fix.

- Invisible micro-spends: Daily ₹99–₹299 swipes on food, subscriptions, and cabs vanish into memory. At month-end, the math never adds up.

- Cash leaks during festivals: Diwali, Pongal, school reopening—costs cluster in bursts. Without category caps or alerts, spending overshoots plans.

- Unshared mental models: One partner tracks, the other estimates. Without a shared dashboard, expectations misalign and money talks become stressful.

- Recurring bill shocks: Missed utility dates or forgotten OTT renewals create late fees and anxiety.

- No feedback loop: If you can’t see trends, you can’t improve them. Every month feels like “start over.”

தமிழ் குறிப்பு: தெளிவான பதிவேடு இல்லையேல் “சிறுசிறு செலவுகள்” பெரிதாகிப் போகும். ஆப் உதவி இருந்தால் உண்மை நிலை உடனே தெரியும்.

Best Budgeting Apps for Indian Families (Top Picks)

1) Axio (formerly Walnut) — SMS-Smart Expense Tracker

Axio’s strength is automatic tracking. When your bank sends a transaction SMS, Axio reads key fields (merchant, amount) and drops the spend into a category. Families who dislike manual entry appreciate this “it just works” feeling. For Best Budgeting Apps for Indian Families, Axio is often the simplest on-ramp to daily visibility.

- Best for: “Set-and-forget” tracking via SMS alerts.

- Why families like it: Minimal data entry, quick charts, helpful reminders.

- Learn more: Axio (ex-Walnut)

2) Money View — Full Financial Overview

Money View attempts a “single pane of glass” approach: expense tracking, category insights, and a broader view of accounts/credit. If your family needs a dashboard that goes beyond grocery and fuel spends, Money View provides a wider lens.

- Best for: Families who want a consolidated money snapshot.

- Why families like it: Useful analytics, reminders, and practical budgeting tools.

- Site: moneyview.in

3) Goodbudget — Envelope Budgeting with Family Sync

Goodbudget uses the classic envelope method—assign money to “envelopes” like Food, School, Rent, and stick to those limits. Because it supports multi-device sync, couples can coordinate in real time. For Best Budgeting Apps for Indian Families that emphasize mindful spending, Goodbudget is a top “manual-but-empowering” option.

- Best for: Families that prefer deliberate planning and envelope limits.

- Why families like it: Shared envelopes, simple interface, strong habit-building.

- Learn more: goodbudget.com

4) ET Money — Budgeting with Investment Tracking

ET Money blends expense tracking with portfolio features (mutual funds, insurance). For families who want to see day-to-day spending and the bigger savings picture, this combination is convenient.

- Best for: Budgeting plus long-term planning in one place.

- Why families like it: SIP calculators, spend analytics, and goal orientation.

- Site: etmoney.com

5) Monefy — Minimal, Beautiful, and Fast

Monefy is intentionally simple: add expenses with a tap, keep categories tidy, and review clear charts. If your family resists complicated setups, this “beautifully basic” route keeps you consistent.

- Best for: Families who want a low-friction, manual-entry routine.

- Why families like it: Clean UI, quick inputs, smooth category management.

தமிழ் குறிப்பு: தானியங்கு (Axio), சமன்படுத்தப்பட்ட கண்ணோட்டம் (Money View), உறுதிப்படுத்தும் கவர்ச்சி (Goodbudget), நீண்டகால நோக்கு (ET Money) — உங்கள் குடும்பத்துக்கு ஏது சரி என்பதைத் தேர்வு செய்யுங்கள்.

How to Choose the Right App (Family Checklist)

When shortlisting Best Budgeting Apps for Indian Families, run this quick checklist:

- Effort level: Do you want automatic SMS tracking or are you okay with manual entry?

- Sharing: Can your partner access and edit the same budget easily?

- Categories: Are common Indian household categories (groceries, school, transport, utilities) easy to set and adjust?

- Reminders: Does the app nudge you to review weekly and pay bills on time?

- Exports & backups: Can you export to CSV/PDF and back up data?

- Privacy: Are permissions transparent (e.g., SMS read-only), and does the app come from official stores?

தமிழ் குறிப்பு: “பயன்படுத்தும் எளிமை + பகிர்வு + தனியுரிமை” — இந்த மூன்றையும் முன் பார்க்கவும்.

Quick 20-Minute Family Setup

- Pick one app from the list above—avoid analysis paralysis. The best Best Budgeting Apps for Indian Families are the ones you’ll actually use.

- Create/confirm categories: Food, Household, School, Transport, Health, Recharge/Bills, Giving, Fun.

- Enable signals: Allow SMS read (for auto-track apps) and notifications. Keep other permissions minimal.

- Daily 2-minute habit: Add cash spends or confirm categories. Note any anomalies.

- Weekly 15-minute review: Open charts together, celebrate good weeks, and adjust one overspending category.

தமிழ் குறிப்பு: “2 நிமிடம் தினமும் + 15 நிமிடம் வாரம்” — இதுவே நீடித்த வெற்றியின் ரகசியம்.

Privacy, Security & UPI AutoPay Awareness

Good hygiene keeps Best Budgeting Apps for Indian Families safe and trustworthy:

- Install only from official stores (Google Play / Apple App Store) and check recent reviews.

- Review permissions: SMS read-only is common for auto-track; deny unrelated permissions.

- Lock your phone (PIN/biometric), and avoid sharing OTPs or card details in chats.

- UPI AutoPay: Understand how recurring mandates work and how to pause/cancel inside your UPI app.

- Backups & exports: Periodically export your data (CSV/PDF) and store securely.

தமிழ் குறிப்பு: அதிகாரப்பூர்வ ஸ்டோர், குறைந்த அனுமதிகள், பாதுகாப்பான லாக்—இந்த மூன்றும் போதுமான பாதுகாப்பு தரும்.

Mini Case Study (Before → After)

Family profile: Two working parents, one school-going child, monthly income ₹1.4L. Frequent food delivery, OTT renewals, sporadic fuel spikes.

Before: End-of-month stress, late fees twice a quarter, no idea how much “eating out” actually cost. Savings goal (₹10k/mo) rarely met.

After 30 days with a budgeting app: Food delivery trimmed by 18% after a weekly review; OTT consolidated to two services; fuel tracked against office commute days; savings goal hit at ₹12.4k with a 5% “Buffer” category added. The family now discusses money for 15 minutes a week instead of firefighting at month-end. Results like these are common when families stick with the Best Budgeting Apps for Indian Families for a month.

தமிழ் குறிப்பு: சிறிய மாற்றங்கள் கூட பெரிய பலனைத் தரும். வாராந்திர 15 நிமிடம் பேசுவது போதும்.

Smart Budgeting Tips for Indian Families

Practical, human-friendly tips help the best budgeting apps do their job. To get the most from the Best Budgeting Apps for Indian Families, use these ideas intentionally:

- One “tough” category in cash: If “Eating Out” is your leak, set a weekly cash envelope. Mirror it in the app so everyone sees progress.

- Festival fund: Create a recurring “Festivals & Gifts” envelope. Add ₹1,000–₹2,000 monthly so Diwali and school reopening don’t derail plans.

- Kids’ pocket money: Use a small “Kids – Learn to Save” category. Show them charts; let them choose one monthly treat within limits.

- Elder care: Track medicines and consultations as a separate health sub-category for realistic monthly planning.

- Agree simple rules: For example, purchases over ₹2,000 require a 24-hour cool-off, or discuss during the weekly review.

- Rename categories to match your life: “Auto/Metro,” “Hostel/School,” “Work lunches,” “Subscriptions” — specificity improves decisions.

தமிழ் குறிப்பு: குடும்ப ஸ்டைலுக்கேற்ற வகையில் பிரிவுகளை மாற்றுங்கள்—வழக்கம் தான் வெற்றியை உருவாக்கும்.

FAQs

Which app is the easiest for beginners?

Axio (ex-Walnut) is popular because it reads SMS alerts and auto-categorizes spends. That’s why many readers start their journey to the Best Budgeting Apps for Indian Families with Axio.

What if my bank doesn’t send SMS or I use cash often?

Choose a manual-friendly tool like Monefy or Goodbudget. Keep categories simple and log cash spends at the end of each day—it takes two minutes.

Can I share the same budget with my spouse?

Yes. Goodbudget is built for shared envelopes, while others allow multi-device sign-ins or cloud sync. Always create a weekly 15-minute review ritual.

Is it safe to grant SMS permissions?

Reputable apps request read-only SMS access to detect bank alerts. Install only from official stores and review permissions regularly. You can revoke permissions anytime.

Do these apps work offline?

Manual-entry apps like Monefy work fine offline for logging spends; cloud sync and backups need connectivity. For auto-track apps, SMS parsing continues, and data syncs when you’re back online.

What about joint accounts and multiple cards?

Most of the Best Budgeting Apps for Indian Families support multiple sources. Use consistent labels (e.g., “HDFC-Primary,” “SBI-Fuel Card”) so charts stay readable.

Can I export my data?

Yes—look for CSV/PDF export. A monthly export stored in your cloud drive gives you an independent backup and keeps year-end reviews effortless.

Conclusion

Best Budgeting Apps for Indian Families work because they reduce friction. Whether you pick an automatic tracker like Axio, a full overview like Money View, an envelope system like Goodbudget, or a simple manual app like Monefy, the goal is the same—shared clarity. Start with one app, create a weekly review ritual, and let your budget reflect your family’s values. Choose one of the Best Budgeting Apps for Indian Families and begin today.

தமிழ் முடிவு: “தெளிவு + ஒத்துழைப்பு” — இது தான் நிதி அமைதிக்கான குறுக்கு வழி.

Keep Reading

- Herbal Drinks for Blood Sugar

- Best Ayurvedic Remedies vs Modern Remedies

- 7 Daily Habits for Weight Loss Without Dieting

- Coconut Oil vs Sesame Oil vs Ghee

Official Resources

Nest of Wisdom Insights is a dedicated editorial team focused on sharing timeless wisdom, natural healing remedies, spiritual practices, and practical life strategies. Our mission is to empower readers with trustworthy, well-researched guidance rooted in both Tamil culture and modern science.

இயற்கை வாழ்வு மற்றும் ஆன்மிகம் சார்ந்த அறிவு அனைவருக்கும் பயனளிக்க வேண்டும் என்பதே எங்கள் நோக்கம்.

- Nest of Wisdom Insightshttps://nestofwisdom.com/author/nestofwisdom/

- Nest of Wisdom Insightshttps://nestofwisdom.com/author/nestofwisdom/

- Nest of Wisdom Insightshttps://nestofwisdom.com/author/nestofwisdom/

- Nest of Wisdom Insightshttps://nestofwisdom.com/author/nestofwisdom/

Related posts

Today's pick

Recent Posts

- Internal Linking Strategy for Blogs: A Practical, Human-Centered Playbook

- AI in the Automotive Industry: A Practical, Human-Centered Guide

- Cloud Tools for Small Businesses and Freelancers: The Complete Guide

- Generative AI in Business: Real-World Use Cases, Benefits & Risks

- 7 Life-Changing Daily Habits for Weight Loss Without Dieting